The “Trans-Fee Mining” model seems to be growing in the smaller, exchanges as evidenced by a couple of recent news stories on FCoin and Bit-Z, CoinBene, and BigOne. Liquidity challenged, smaller, cryptocurrency exchanges compete for users and funds. Exchanges adopting this model seem to be enjoying record volume.

FCoin, based out of China, led by former Huobi CTO, Zhang Jian, (according to this paid press release) is perhaps considered the pioneer of this model with Bit-Z and CoinBene implementing similar models.

Using the FCoin whitepaper, here’s a brief look at how this proposed model will work. It is important to add forward looking emphasis, as the project is only a little over a month old with most of the concepts still waiting to be tested in the months ahead.

FCoin (FT) is an issued token, it is not mined.

FT provides transaction free mining. The platform charges fees, payable in BTC or ETH and then issues FT to reimburse 100% of the fees. It functions similar to a reward token, giving the trader FT as a reward for utilizing the platform.

Total Supply = 10 billion

Token Distribution

Private Sale = 5%

Strategic Partners = 9%

Founding Team = 12%

FCoin Fund = 23%

Community Rewards = 51%

The FT tokens in the Community Rewards serve as the reimbursements.

What may be some of the potential benefits and uses of this model? For the exchange, this certainly would increase the supply of BTC and ETH. Additionally, with ICO fatigue, and projects looking for innovative methods to increase user adoption, this will serve to distribute the token and increase network effects. Finally, the exchange will see increased volume.

For the FT token holder, the rights and interests are:

- Revenue distribution – 80% of the revenue will be distributed to token holders and the remaining 20% will be used for operations and future growth

- Voting – FT holders will be able to vote using smart contracts on operational decisions and governance

So far, transaction free trading and participation in an autonomous organization sounds ideal. What could possibly go wrong? Let’s have a look at some of the criticisms raised to date, mainly by Binance Co-founders:

- Is it an ICO? The user is paying BTC or ETH for the token. Albeit, there is the utility of a trade in the mix, substantively it resembles an ICO.

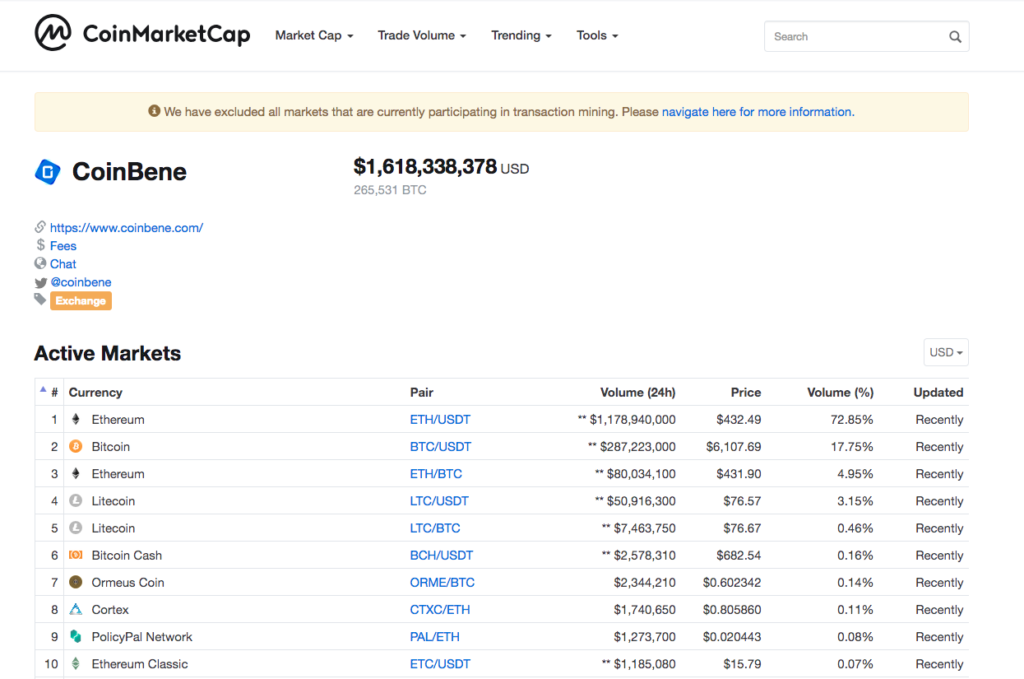

- With “no fee” trading, it is possible to “create” fictitious volume. Traders may trade with themselves or a bot. Coinmarketcap.com, an exchange aggregator, will not include trades from “no fee” exchanges in the price and total trading volume because it is not possible to verify the true volume.

- Token price manipulation. Even if the platform is transparent, the team and project control a significant amount of the circulating supply. It does not seem difficult to imagine a bot or a small number of individuals could quickly earn a majority of the community.

- Is it sustainable? After distribution of the tokens, how will the tokens re-enter the ecosystem?

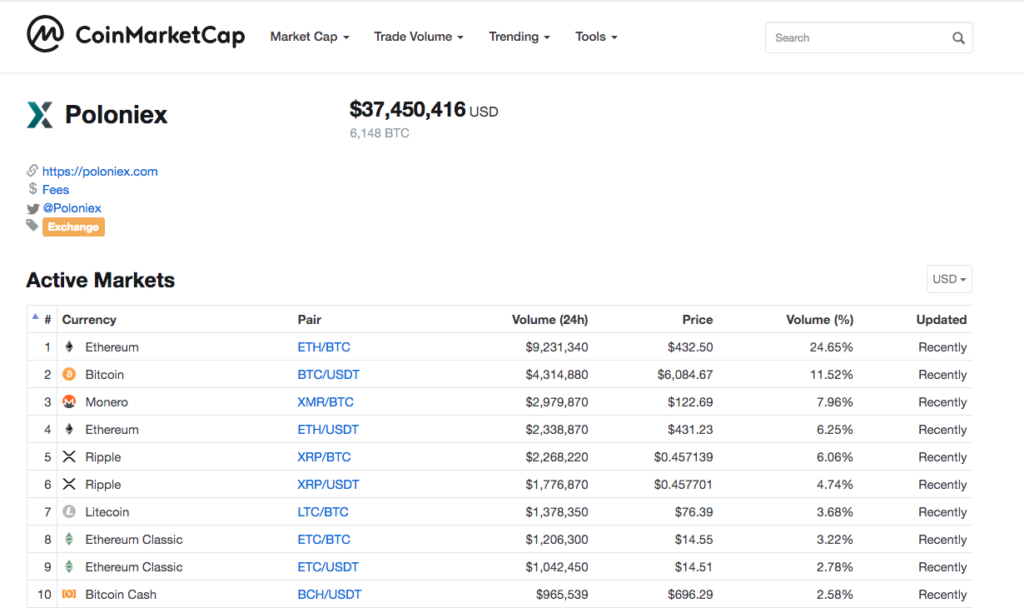

The screen shot below of CoinBene on CoinMarketCap demonstrates some of these potential concerns. You will see the significant volume and “**” indicate that it cannot be counted toward total volume for the trading pair. To give reference, I’ve included Poloniex volume also. If you are following “Tethers,” you know that a recent study found limited “Tethers” returning or burning. Perhaps they’re all stuck on CoinBene?