TL, DR: Companies are looking for additional access to capital markets. Will we see a rise in reverse merger activity? When considering investments, read the disclosures or consult someone who does. Consider the speed at which a company is going to market, if taking shortcuts, are the elements in place for sustainability?

TL, PNR (prefer not to read): Watch “The China Hustle”

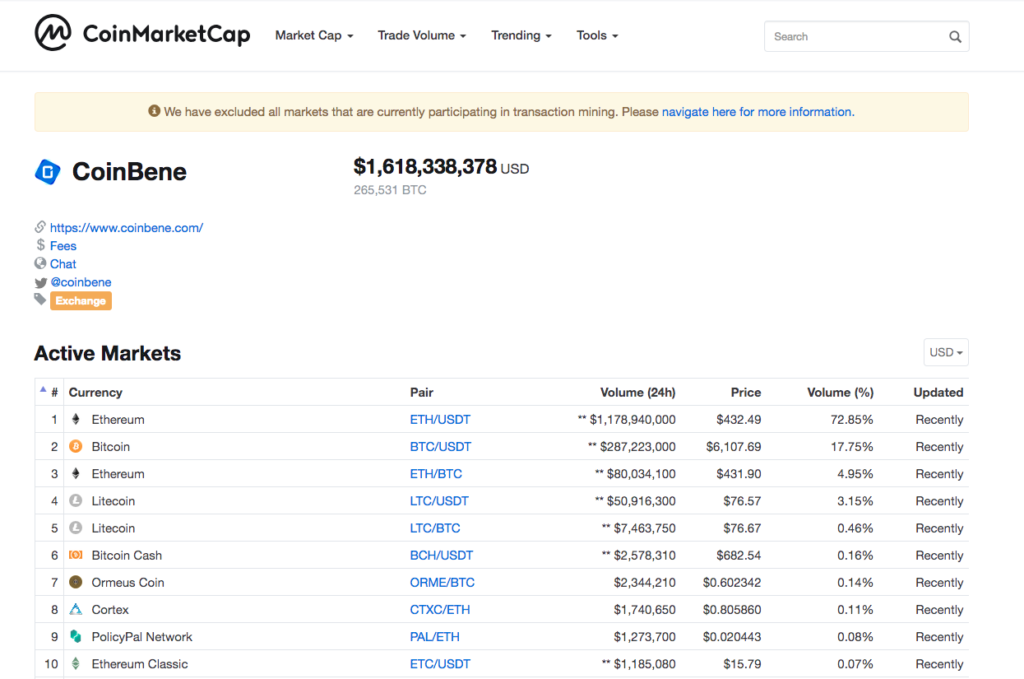

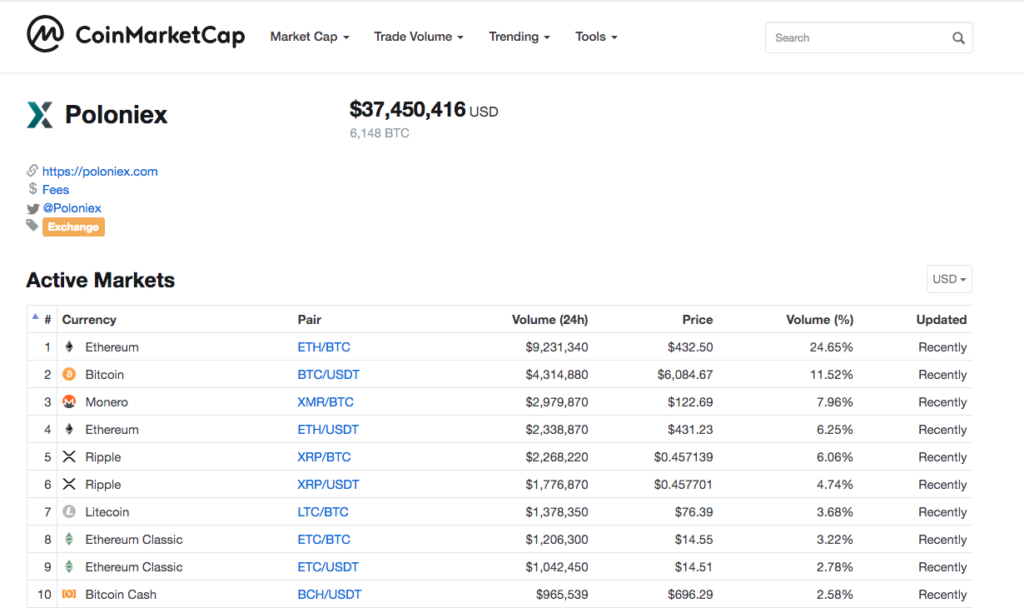

Initial Coin Offerings (ICOs) and unregulated capital raises are winding down. The crypto currency market is down considerably from record highs in early 2018. There is little movement in institutional, synthetic product approvals. Projects and companies are looking for access to additional capital.

Cryptocurrency mining companies and exchanges seem to be eyeing the traditional equity markets. First to market and dominance remain a coveted position. It is no surprise that companies are seeking shortcuts to the markets.

Coinbase, Robinhood, Binance, and Coinsquare all seem to be taking a more calculated, deliberate approach. Whether they confirm, deny, or remain silent, at a minimum, they are making appropriate acquisitions, hires, and decisions to position themselves for a traditional path to the capital markets. Namely, an initial public offering (IPO), where investors actually receive ownership in the company in exchange for their capital, with the expectation of a return on their investment.

There are others that may not have the patience or the desire to spend the capital required to take the conventional path: two-years of audited financial statements, legal and underwriting costs, registration with the SEC, etc.

One short cut is known as a reverse takeover or a reverse merger. Two current examples of these include Netcoins, Inc. (CSE: NETC) and Galaxy Digital (TSX-V).

We can look to the US markets between 2006 to 2012, to get a sense of how this process works, and what type of research one may consider before investing. While a reverse merger can happen with two domestic companies, during this period we saw an influx of Chinese companies gaining access to the US markets through reverse mergers, known as CRMs.

How a reverse merger works:

A private company finds a public company that is distressed or defunct but is publicly listed on a US exchange (a shell company). The shareholders of the private company exchange their shares for controlling interest (the outstanding, voting shares) of the public company. Once this merger occurs, the private company takes over management of the publicly traded company, alerts the SEC and investors through the Form 8-K filing, often accompanied by a name change.

As long as the newly formed merger maintains the listing requirements of the exchange, the stock will trade.

Sounds like a fairy tale, right? Smaller investors have the opportunity to become a part of deals traditionally reserved for the “whales” and institutional investors. Companies have access to a greater pool of capital, can increase their presence, and enjoy global credibility. All at a much faster and less expensive pace.

What could go wrong? Well, there are significant risks. These risks are to be detailed in the financial statement filings. I’ll highlight a few that should be included and why there is merit to their inclusion beyond: “our auditors, lawyers, and regulators require.”

If you read the disclosures, which public companies are required to include in their filings with the SEC, in a reverse merger you should see disclosures along the lines of:

- Limited experience running a public company – being under public scrutiny involves significant compliance, costs, and experience. Much of the crypto twitter activity we see would be investigated for securities fraud and price manipulation.

- Brokerage firms and analysts are not likely to recommend – this is due to lack of history and compliance. This could put a strain on liquidity and the ability to raise the desired capital.

- The cost to comply with the SEC reporting requirements are significant and failure to do so could result in delisting.

It is worth going further back to read the prior filings and research the issues with the shell. It is likely that there were shareholder lawsuits or other outstanding concerns that may remain as a contingent liability.

Now add a few cryptocurrency disclosures and risks:

- Lack of guidance – currently there is debate in the industry as to how to account for cryptocurrency. Best practices point to treatment as an intangible asset. This means that it is recorded at cost, subject to impairment. The outcome of this treatment is that only losses are reported, and any subsequent gains are not considered. This method further restricts the ability of miners to capitalize costs associated with mining cryptocurrency. Some companies are applying the fair value method and reporting gains. At the very least, one must read the disclosures to further understand how the company is reporting and recognize that this may vary significantly from a competitor.

- Regulatory uncertainty – there remains regulatory uncertainty, particularly in the US with regard to digital assets. Pending regulation could affect a company’s operations, particularly if they do not have a diversified revenue stream.

- Inexperience – despite many believing a conference attendance or an acronym makes them an expert, everyone in this industry is inexperienced in some area. Including the auditors. Many firms hire smaller audit firms that may not have the resources or experience, potentially leaving out some critical considerations.

Finally, let’s compound it with a global aspect:

- These are not necessarily dual-listed companies. One company may actually remain private. Or at a minimum, one company is under SEC jurisdiction and the PCAOB, and one is not. The documentary, “The China Hustle” explains CRMs and short selling very well.

- Opaque global reporting – global markets does not necessarily translate to information transparency

- Differences in accounting treatment – While there is convergence in US generally accepted accounting principles (GAAP), China GAAP, and International Financial Reporting Standards (IFRS); we still have differences in each, particularly with regard to consolidations and mergers. And of course, Belarus, I believe may be the only one leading the accounting industry with cryptocurrency treatment.

I raise these risks in an effort to create awareness, learn from history, and forward the discussion on the consistency of reporting. I very much want to see this space evolve and grow, hopefully without repeating some prior mistakes along the way.

In the days ahead, my attention is on the miners and Hong Kong. Bitmain, Caanan Creative and Ebang are all openly talking IPO. The Hong Kong Exchange is likely to be the home court for these offerings. Additionally, Hong Kong is entertaining methods to make it easier for companies to go public. Similar to Canada with the Ventures Exchange (TSE-V).

Bitmain – The success to date of this company is undeniable. It is fascinating to watch their positioning, placement, responses, and activity. I’ve talked at length (yes, great length, another thank you to my gracious hosts and anyone willing to listen) on the Henry Raines Show and with Sasha Hodder on the HodlCast of the figures and ideas currently circulating. Next up is a mining summit in Tbilisi, Georgia, with Jihan Wu of Bitmain and Roger Ver of Bitcoin.com at the end of this week. The location is interesting as, this is also home to Bitfury’s mining operation.

Additional Resources:

SEC investor guide

The China Hustle

Journal of Forensic and Investigative Reporting – GAAP Difference or Accounting Fraud?

Disclaimer: This article was intended for informational and educational purposes. Nothing herein should be taken as investment, tax, or legal advice. I do not own positions, nor do I intend to take positions in any of the mentioned companies. I hold bitcoin and other cryptocurrencies but do not engage in short-term trading. Some are here for speculation, others for the memes, I’m in it for the disclosures.