Last week started with an article where the president and CEO of the American Institute of CPAs, Barry Melancon, called for accountants to embrace emerging technology, particularly the blockchain. Sadly, his choice of words may not have been the best in mobilizing the profession. I trust his intention was to not allow the fear of technology to be the reason we ignore it.

“We don’t need to really understand the underlying software,” he said. “It’s the implications and power of blockchain that are more important that (sic) the actual software.”

I disagree. I believe that we do need to understand the underlying software. Not to the degree of being able to program or develop, but we need a clear understanding of the terminology, applications, and how certain platforms differ from others; particularly as it relates to our respective disciplines. For example, my work with retail clients. I cannot write code for a point-of-sale system, but by learning the underlying systems, I know where to look for vulnerabilities and determine if an area requires additional controls.

The first questions I am asked by my peers interested in learning about blockchain is generally one of the following: “How do you know all of this?” “Where do I start?” “What is Bitcoin?” or “When should I buy bitcoin?”

I had the pleasure of being in studio for The Henry Raines Show this week where we had, Bitcoin pioneer, Charlie Shrem, of Crypto.IQ as a guest. A powerful reminder that what you read and hear is not always a complete story or worthy of developing an informed opinion. Charlie left us with a final thought, the one question we fail to ask, should be our starting point.

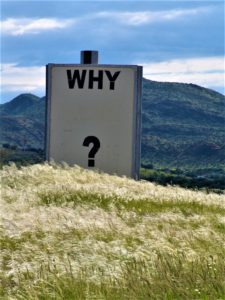

“When it comes to Bitcoin, don’t ask ‘What is it?” ask “Why is it?”

Start with “Why?” And if you think that our current processes and systems are working, if you cannot recall some accounting scandals, failed regulation, or even relate to an example of occupational fraud, I have a primer for you: this presentation by Caitlin Long. Regardless, I urge everyone to watch. She does a remarkable job of explaining the overleveraged nature of our current economy and highlights a couple of accounting examples where “we” could never arrive at the same number twice.

For those who revert to asking “What?” and remain comfortable with stopping at the uniformed answers of a Ponzi scheme or “Tulip Mania,” I ask that you refrain from draining the limited US resources in convincing you otherwise at this time. “Why?” As you will hear from both Shrem and Long, the US is so far behind in this space.

We need to leverage the resources of the accounting professionals and local leaders like Joel Greenberg, the Seminole County Tax Collector (and another great interview) interested in moving our community and country forward.

Both interviews and the presentation have downloadable audio. No excuses. Find the “why.”

This post and the contents included are provided for informational purposes and shall not be considered legal advice.

Photo by Ken Treloar on Unsplash